If there are two types of policies that I most vehemently oppose—alongside all pro-war policies—they are attempts to regulate society in favor of corporations and attempts to extract from and/or weaken the working class. Under state capitalism, these sort of policies tend to go hand in hand, and, unsurprisingly, have continued to do so under the current U.S. administration. Now the attack comes against credit unions specifically, as banks are currently lobbying to end the federal income tax status of credit unions across the country. The trade association America’s Credit Unions outlines how…

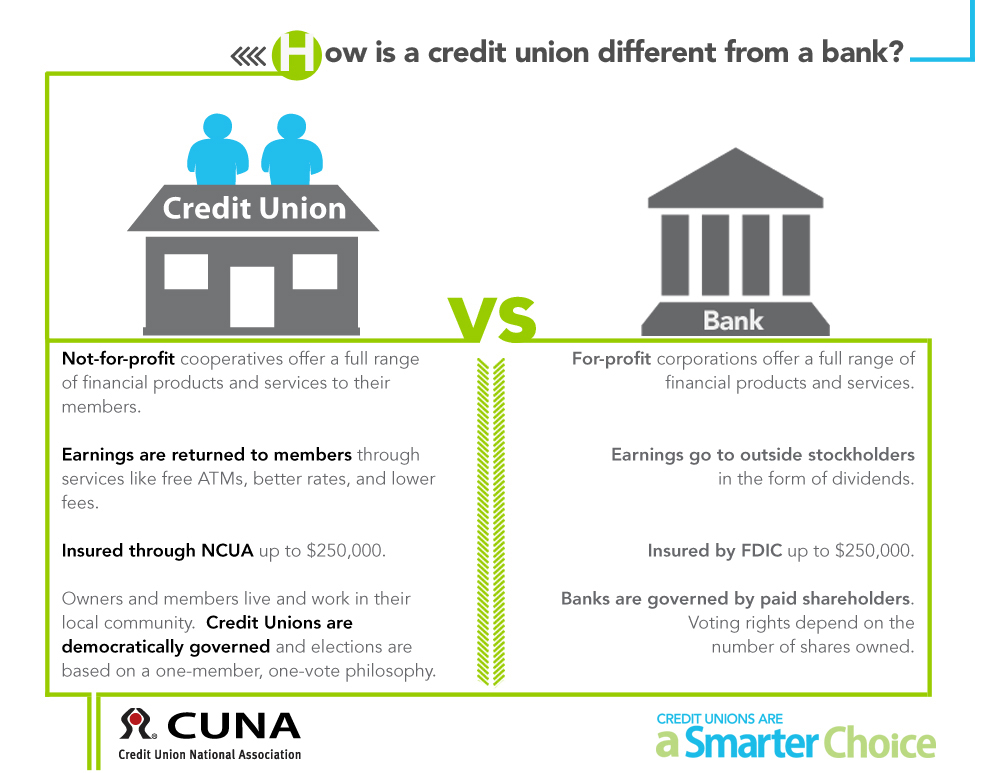

credit unions do not pay federal income tax on profits because those profits are returned back to members in a variety of ways, – and credit unions DO pay many local, state, and federal taxes and fees. That includes payroll and property taxes, and the dividends that credit unions pay to their members are taxed as personal income.

Keith Taylor and Nathan Goodman, in their paper on Edward Filene for the Journal of Institutional Economics, analyze how forming financial cooperatives has often been cost prohibitive and required outside grants to establish and maintain the credit union sector. To force credit unions to pay this extra tax would add a whole new layer of costs upon these not-for-profit financial institutions and their member-owners.

Not only do credit unions, as I argue, offer immediate alternatives to free (and mutual) banking—alongside proposals like Gary Elkin’s mutual banking clearinghouse and numerous community currencies—but they also work in favor of greater working class autonomy. Credit unions tend to cater to lower-income clients more than traditional banks, function upon a cooperative/democratic basis, and circulate funds within the communities they serve. As ACU’s site Don’t Tax My Credit Union writes:

Even as the credit union movement has grown, it remains a small but vital part of the financial landscape: Credit unions serve 43% of all Americans, but hold only 8.8% of assets in financial institutions, a clear indication of efforts to help people build their savings and improve their finances. The remaining 91.2% of Americans’ assets are held by banks. But that hasn’t stopped banks’ greed and desire to eliminate any competition. That’s why they want Congress to eliminate the credit union federal income tax status.

This cannot be allowed to happen. Credit unions need to be defended, as they are some of the very few democratic financial entities that exist under American state capitalism. In response to this threat, America’s Credit Unions has launched the aforementioned website to offer an opportunity for folks to contact their legislators and express their opposition to this attack on economic self-governance in working class communities. Check it out!